Choosing the right crypto pair is one of the most important decisions you will make in spot trading. On FYNOR, traders have access to a wide variety of trading pairs, including major cryptocurrencies, stablecoins, new projects, and trending tokens. But with so many options available, how do you know which pair is right for you?

This guide explains everything you need to know—step by step—so you can confidently choose the best crypto pairs for spot trading on FYNOR.

What Is a Crypto Trading Pair?

A crypto trading pair represents the exchange rate between two digital assets. For example, in the pair BTC/USDT:

-

BTC is the base asset (the coin you want to buy or sell)

-

USDT is the quote asset (the currency you use to measure its price)

If BTC/USDT is showing 60,000, that means 1 BTC = 60,000 USDT.

Understanding this basic concept helps you compare prices, analyze markets, and decide which pair fits your trading plan.

1. Choose Pairs With Strong Liquidity

Liquidity refers to how easily and quickly you can buy or sell a crypto without affecting its price. High-liquidity pairs offer:

-

Faster order execution

-

Lower spread between buying and selling price

-

Less slippage during large trades

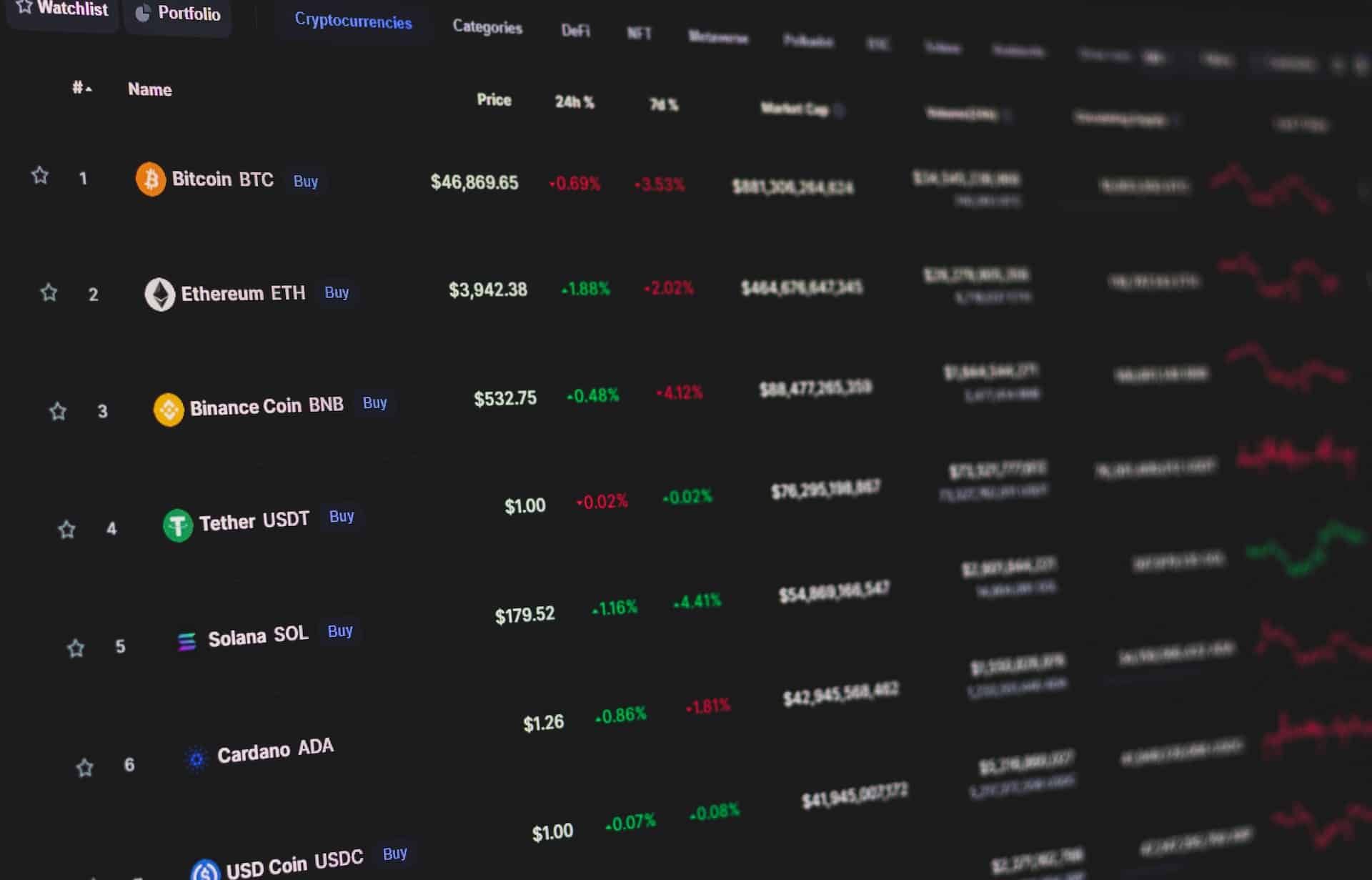

On FYNOR, popular pairs like BTC/USDT, ETH/USDT, BNB/USDT, and SOL/USDT generally offer the highest liquidity. These pairs are ideal for both beginners and professional traders.

Low-liquidity pairs may seem attractive because they can move fast, but they also carry higher risks such as sudden price spikes and difficulty exiting a losing trade.

2. Understand the Volatility of Each Pair

Volatility is how much a crypto’s price moves within a certain period. Some pairs move slowly and steadily, while others are extremely volatile.

-

High-volatility pairs

Examples: New tokens, meme coins, low-cap projects-

High profit potential

-

High risk

-

Requires experience and strong risk management

-

-

Low-volatility pairs

Examples: BTC/USDT, ETH/USDT-

More stable

-

Better for beginners

-

Easier to predict

-

Your risk tolerance determines which type of pair suits you best. If you’re new to trading, it’s safer to start with stable pairs that move more predictably.

3. Look at Trading Volume

Volume shows how much of the coin is being traded in the last 24 hours. High volume means more traders are active, which usually equals:

-

Better trading opportunities

-

More price stability

-

Faster execution

-

More reliable technical patterns

Trading pairs with extremely low volume may not reflect true market conditions, which makes analysis and trading more difficult.

On FYNOR, you can quickly check the 24-hour volume of any pair before placing an order.

4. Analyze the Market Trend

Before choosing a pair, you need to understand what the market is doing. There are three common market conditions:

Uptrend (Bullish Market)

Buyers are in control. Prices are rising.

Pairs like BTC/USDT and ETH/USDT tend to perform well.

Downtrend (Bearish Market)

Sellers dominate. Prices fall.

In this condition, traders may switch to stable pairs or use strategies like short selling (not applicable in spot trading but used in futures).

Sideways Market (Consolidation)

Prices move within a fixed range.

Good for range trading or short-term strategies.

FYNOR’s advanced charting tools help you clearly see which way the market is moving.

5. Research the Fundamentals of the Coin

Every cryptocurrency has its own purpose, team, technology, and future potential. Before choosing a pair, research the base asset:

-

What does the project do?

-

Is it popular and well-supported?

-

Does it have upcoming announcements or updates?

-

Is it trusted in the crypto community?

-

Does it have strong long-term potential?

Strong fundamentals often lead to more stable price movement and good long-term results.

6. Use Technical Indicators to Support Your Choice

FYNOR provides advanced tools such as:

-

Moving Averages (MA) – Helps identify trend direction

-

Relative Strength Index (RSI) – Shows whether an asset is overbought or oversold

-

MACD – Indicates momentum and possible reversals

-

Bollinger Bands – Helps measure volatility

-

Support & Resistance levels – Shows key price zones

Before choosing a pair, analyze its chart for:

-

Clear trends

-

Strong support levels

-

Consistent price movement

-

Good entry zones

A pair with unpredictable or weak chart patterns may not be a good choice for spot trading.

7. Match the Pair With Your Trading Strategy

Your trading style directly affects the kind of pairs you should choose.

Scalpers

Prefer high-liquidity pairs with tight spreads like

BTC/USDT, ETH/USDT, SOL/USDT.

Day Traders

Choose pairs with strong intraday movement.

Can trade both major coins and strong mid-cap tokens.

Swing Traders

Look for pairs with clear medium-term trends.

Long-Term Investors

Prefer stable and reputable pairs.

Before placing any trade on FYNOR, define your strategy and choose pairs that match your goals.

8. Watch Global News & Market Events

Crypto markets react quickly to news. A coin’s price can move because of:

-

Regulatory updates

-

Technological upgrades

-

Partnerships

-

Listings

-

Market rumors

-

Global financial events

Pairs linked to trending coins often experience sharp movements. Always check the news before choosing a pair—especially if it’s a new or volatile project.

9. Check Fees and Trading Costs

Spot trading on FYNOR comes with low fees, but you should still consider:

-

Maker/Taker fees

-

Spread cost

-

Potential slippage

High-liquidity pairs usually have lower overall trading costs, making them more suitable for frequent trading.

10. Diversify Your Crypto Pair Selection

Avoid putting all your money into one pair. Diversification helps reduce risk and balance losses. Example diversification:

-

40% in major pairs (BTC/USDT, ETH/USDT)

-

30% in strong mid-caps

-

20% in trending tokens

-

10% in high-risk speculative coins

FYNOR offers enough variety to build a well-balanced portfolio.

Final Thoughts

Choosing the best crypto pair for spot trading on FYNOR involves analyzing liquidity, volatility, fundamentals, news, technical indicators, and your personal risk tolerance. There is no “perfect pair” for everyone—your choice depends on your goals, trading style, and market conditions.

Start with simple, strong pairs like BTC/USDT or ETH/USDT, then gradually explore other pairs as your confidence grows. With proper research and strategy, FYNOR gives you all the tools you need to trade smarter and more successfully.